The world's first autonomous collections and servicing team

Build, deploy, and manage browser and voice AI agents that collect and service loans across every channel — no engineering required.

What sets us apart.

Most AI collection tools bolt a voice agent onto broken workflows. We rebuilt the entire stack.

Sarah Johnson

Hi Sarah, this is a reminder about your account balance of $2,450...

Michael Roberts

Your payment plan has been approved. First payment due Jan 25th.

James Davis

Thank you for your payment! Your remaining balance is $1,200.

Emily Wilson

We haven't been able to reach you. Please call us back at...

Unified lending data layer

One source of truth across your LMS, dialer, email, and internal tools. Our unified context layer provides the borrower context most voice agents lack — powering personalized risk models that actually move collection rates.

Transcribing

Compliance agent actively monitoring...

Compliance first automation

Every interaction — voice, SMS, email — is logged, auditable, and monitored in real time against FDCPA, CFPB, TCPA, and state regulations. Our Compliance agent flags deviations before they become complaints or lawsuits.

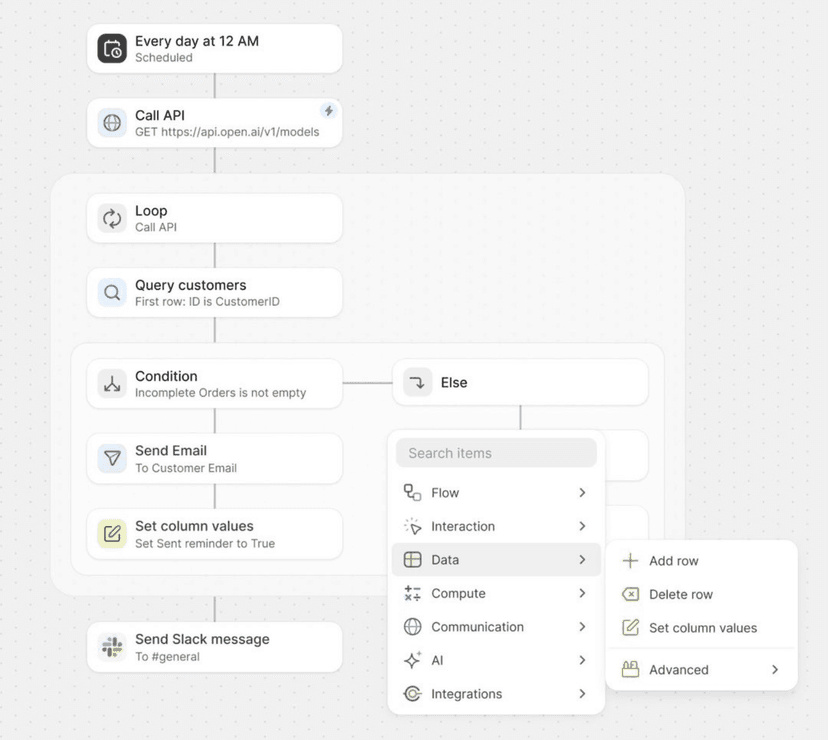

Automate any workflow, no engineering required

Turn your SOPs and screen recordings into custom AI agents that handle 90% of manual servicing and collection workflows. Our browser agents use proprietary computer vision to work across your existing platforms — no APIs, no integration projects, no engineering resources needed.

AI agents that work.

Your collections team can't reach every delinquent account. Ours can.

We build autonomous collection and servicing teams powered by a unified data layer across your entire lending stack. Our agents don't just dial — they research the right contact, personalize every interaction, negotiate repayment plans, and execute your SOPs end-to-end, across voice, SMS, and email.

Right Party Contact Agent

Leverages 50+ data sources to find the best way to reach each borrower, improving first-contact rates by 20pp.

Collections Agent

A voice and omni-channel agent trained on gold-standard collection practices, deeply personalized with full borrower context, and adaptive in real time.

Compliance & QA Agent

Monitors every communication across all channels, proactively flagging risks across FDCPA, CFPB, and HIPAA before they become regulatory headaches.

“We've advised banks on credit risk at McKinsey, led Growth and FinCrime at fintechs, and built security infrastructure at Bloomberg. We've seen why AI agents fail in financial services: they're bolted onto broken systems. So we aim to solve this by building the foundation first — an enterprise system of record designed from day one to power agents that actually deliver measurable results to a bank's P&L.”